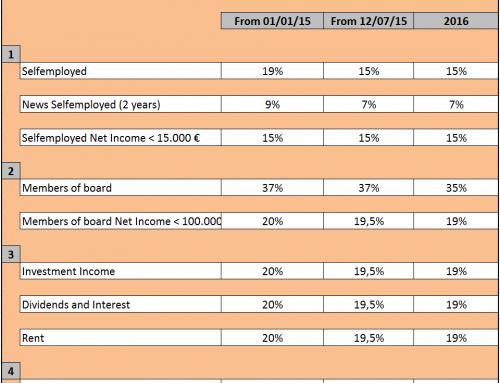

Friday morning the tax cut planned for January 1, 2016, will be approved.As the government announced the reduction of income tax will be brought forward to July 1 of this year, retroactively. Obviously the proximity of the general elections has influenced this unexpected decision.Because this exercise will be unique in that there will be 2 sections of taxation, which entered into force on 1st of January 2015 and the one planned for July 1st of this year, the Tax Agency has decided to develop a single rate of income tax to be applied for all of 2015.This rate will be an average of the two rates that came into effect last January and those planned from July 1st. As the application of this rate averaged from January 1st 2015.In this way we try to avoid any technical problems that might be generated in the tax returns for next year.The income tax reform implemented at the beginning of this exercise consisted of:

- The reduction of sections from seven to five.

- Reducing the minimum rate of income tax, which decrease from 24.75% to 20% in 2015.

- Reducing the marginal rate from 52% to 47%.

For the year 2016 a further reduction of tax rates is anticipated:

- The reduction of the minimum rate of income tax will change to 19%. • Reducing the marginal rate to 45%.

The resulting rate is an average of the two aforementioned.To assess the real impact of this measure we take for example that an average salary of 22,726 euros there will be a savings this year of just over 10 euros per month starting this month, with annual savings of about 60 €.The approval of the rate reduction retention Self-employed or Autonomous from 19% to 15% is also planned.Finally, the tax cut will also affect income from savings. Thus, from July 1, income from savings of up to 6,000 euros will have a tax of 19%. Between 6,000 and 50,000 euros will be taxed at 21%, and higher income than 50,000 euros will have a rate of 23%. The three sections are reduced a percentage point regarding the current situation.

Leave A Comment